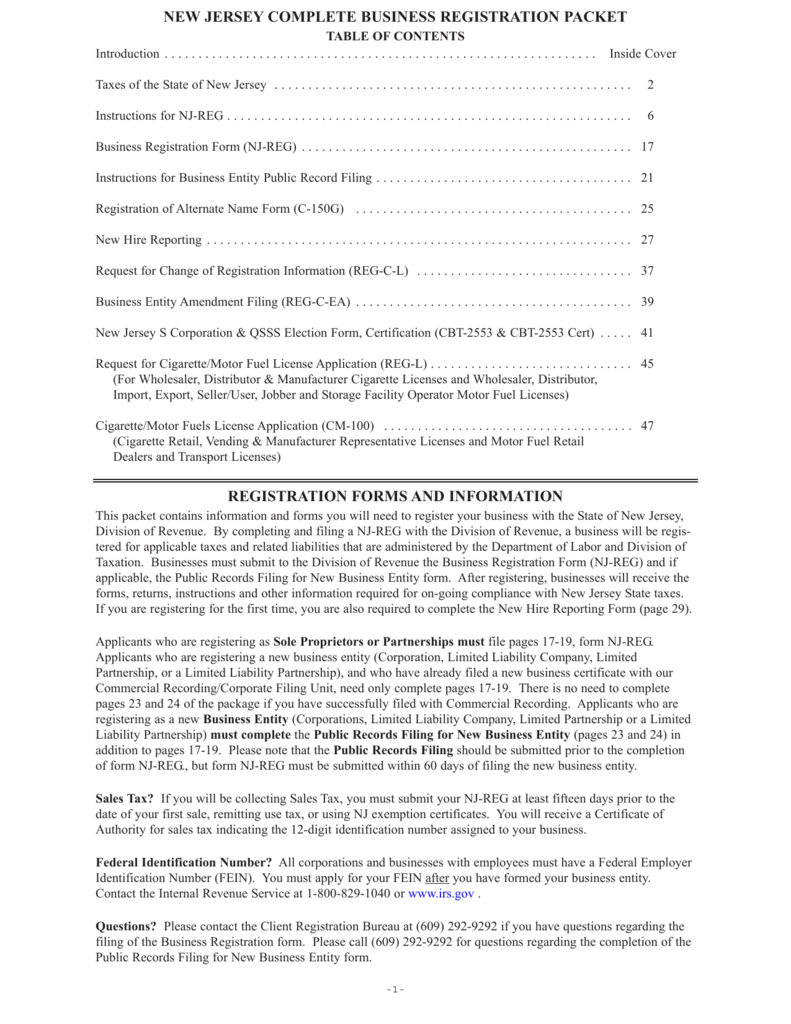

nj bait tax form

Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. PTEs taxed as S corporations will compute distributive proceeds based on the three factor allocation formula Schedule NJ-NR-A which is based on cost of performance.

Recent Changes To The Nj Bait Pass Through Entity Tax Pte Bkc Cpas Pc

The New Jersey pass-through entity tax took effect Jan.

. Line 35a NJ-1041 Line 7 NJ-CBT-1065 Form 329 CBT-100 CBT-100S CBT-100U. On the bottom of the form is a box for the members share of business alternative business income tax which should be reported on the business owners new jersey personal return as a credit to offset any new jersey tax liability. New Jersey Apportionment For tax year 2021 S corporations calculating their BAIT tax base may use either the default apportionment method for S corporations which is a single-sales.

The elective entity tax is 10868750. The tax is calculated on every members share of distributive proceeds including tax exempt members. 1418750 652 over.

Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated. If the sum of each members share of distributive proceeds attributable to the pass-through entity is. For the amount of tax paid on its share of distributive proceeds on Form NJ-1065 or claim it as a credit on its own Form PTE-100.

Pass-Through Business Alternative Income Tax Act. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business. When filing the return the PTE has an overpayment that it.

They must also pro-vide Schedule PTE-K-1 to each member reporting the amount of the members share of distributive proceeds and Pass-Through Business Alternative Income Tax. The credit may not reduce the tax liability below the statutory minimum tax. See Form NJ-1040X resident or the instructions for Forms NJ-1040NR nonresident or NJ-1041 fiduciary if you need to amend a previously filed New Jersey Income Tax return.

Pass-Through Business Alternative Income Tax PTEBAIT. NJ Division of Taxation Subject. By Jason Rosenberg CPA Withum January 15 2021.

This way it reduces the federal taxable income on your personal return which is what the. Out-Of-State Winery License For Direct Ship Wine Sales to New Jersey. The tax rates for NJ BAIT range from 5675 to as high as 109 on New Jersey sourced income.

Motor Fuels Tax. The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022. Each electing pass-through entity must submit form PTE-100 a PTE-K1 for every owner and form NJ-NR-A if the pass-through entity is conducting business both inside and outside NJ.

Nj bait tax form. Pass-Through Business Alternative Income Tax Act. New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub.

Do not use this form to claim a refund of individual Gross Income Tax. The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year. Form PTE-100 and pay the tax due.

Starting with the 2021 reporting year the BAIT computation begins with New Jersey taxable income and results in better alignment with the owners New Jersey tax liability. Members will include a copy of the Schedule PTE-K-1 with their New Jersey Gross Income Tax or Corporation. PL2019 c320 enacted the Pass-Through Business Alternative Income Tax Act effective for tax years beginning on or after January 1 2020.

Claim for Refund Business Taxes Only Claim for Refund. This date is not extended. Since the passage of the legislation the NJ Division of Taxation has created and updated its Frequently Asked Questions which contain general information about the BAIT as well as information on making the election making estimated tax payments and calculating the tax.

PTEs wishing to pay the BAIT will be required to make quarterly estimated tax payments which. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. For New Jersey purposes income and losses of a pass-through entity are passed through to its.

2021 PTE-200-T 2021 Revocation forms and 2022 Estimated Payments. The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns.

For New Jersey tax purposes income and losses of a pass-through entity are passed through. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level. Assume a PTE filed its 2021 BAIT return on March 1 2022.

This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level. The New Jersey pass-through entity tax took effect Jan. Pass-Through Business Alternative Income Tax PTEBAIT Petroleum Products Tax.

For 2022 BAIT purposes PTEs taxed as partnerships will compute distributive proceeds based on the information reported on their entitys Form NJ-1065. 2021 Pass-Through Business Alternative Income Tax Member s Share of Tax Form PTE-K-1 Keywords. Public Community Water System Tax.

If a New Jersey S corporation is a partner in a tiered partnership. New Jersey is one of the latest states to enact such a SALT workaround using an entity-level tax known as the Pass-Through Business Alternative Income. 2021 Pass-Through Business Alternative Income Tax Members Share of Tax Form PTE-K-1 Author.

An extension of time to file may also be requested by submitting form PTE-200-T and by paying at least 80 of the total tax for the taxable year by the original due date of the annual. The credit seems to be a state income tax payment made by the entity and then passed over to the individuals as a credit towards their tax liability. The tax rates for NJ BAIT range from 5675 to as high as 109 on New Jersey sourced income.

An exempt corporate member can claim a refund for tax paid by the pass-through entity on its share of distributive proceeds. New Jersey Business Alternative Income Tax NJ BAIT Knowledge Hub. It is used to offset the tax on the individual return.

Enter it as a business expense under taxes states taxes paid. Returns due between March 15 2022 and June 15 2022 are now due by June 15 2022This includes the 2021 PTE Election 2021 PTE-100 Tax Returns 2021 PTE-200-T 2021 Revocation forms and 2022 Estimated Payments. Claim for Refund UEZ.

Claim for Refund Business Taxes Only Form A-3730 Author. Tax is imposed on the sum of each members share of distributive proceeds which is 1500000. 6308750 45600 1500000-1000000 500000 x 912 45600 10868750.

NJ BAIT Deduction on Form 1040. Call the division of revenue and enterprise services 24000 400k x 6 the nj bait. Using the table above tax is calculated on the 1500000 as follows.

New Jersey Division of Taxation Subject. A national trend ensuing the Tax Cuts and Jobs Act TCJA has been states attempts to circumvent the 10000 state and local tax SALT deduction limitation. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business.

New Jersey Complete Business Registration Package

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

Tax Relief If You Live In New Jersey

Nj Bait Deduction On Form 1040

New Jersey Enacts Salt Deduction Cap Workaround Grant Thornton

Nj Bait Forms Have Been Released News Levine Jacobs Co

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

New Jersey Enacts Legislation To Fix Its Business Alternative Income Tax Bait Wilkinguttenplan

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

Nj Bait And New Salt Guidance What You Need To Know Smolin

Nj Business Alternative Income Tax Bait Now Improved